installment open end credit example

A good example of an open-end credit is A the use of a bank credit card to make a purchase. An example of an installment loan would be a car loan you are required to pay a set amount of money at a recurring interval ex.

Printable Bank Account Information Tracker Pdf 8 5 X 11 Size Etsy Accounting Information Accounting Bank Account

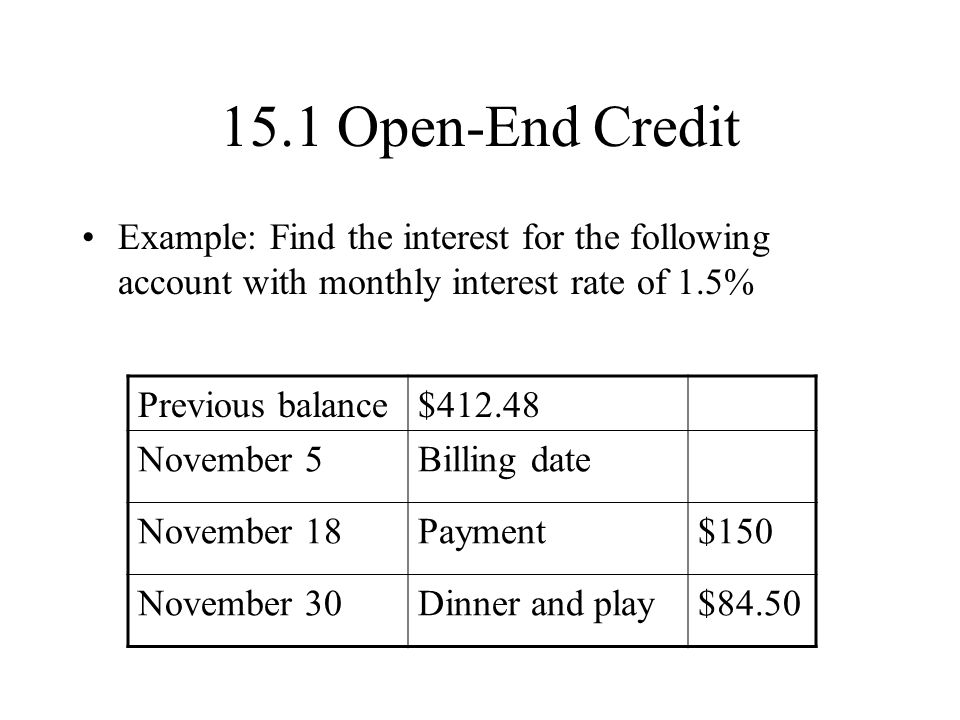

Open End Credit This is a type of credit loan paid on installments in.

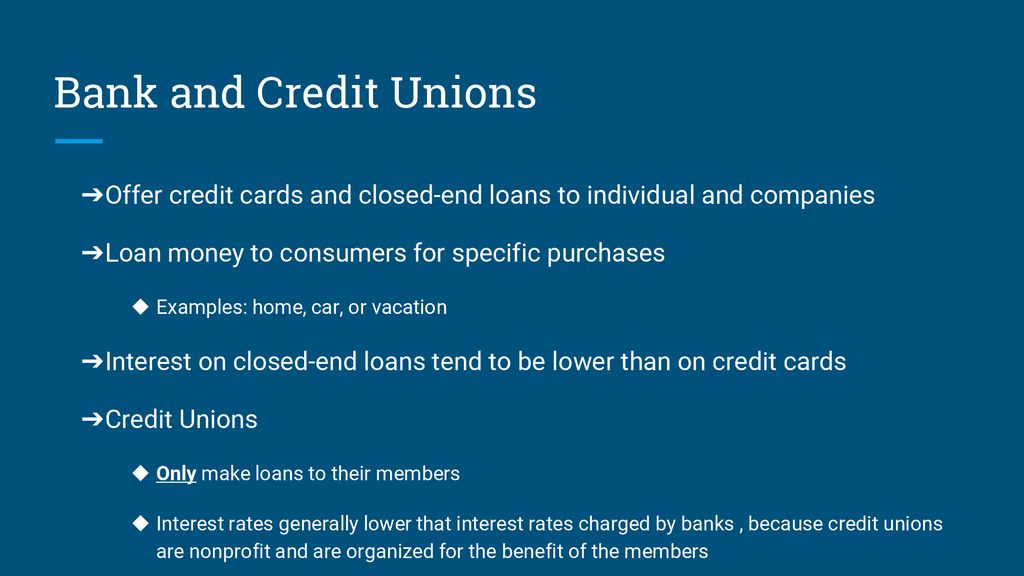

. Generally real estate and auto loans are closed-end credit. The issuing bank allows the consumer to utilize borrowed funds in exchange for the promise to repay any debt in a timely manner. Depending on the product you use you might be able to access the funds via check card or electronic transfer.

Unlike closed-end credit an open-end credit can be used for your frequent and unexpected financial needs and not necessarily for a specific purpose. To understand it better a line of credit as used in the. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans.

For more information see revolver debt versus installments. Credit cards are the best examples of open-end credit mostly unsecured. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes.

280 per month until the loan is paid off in full. A loan can be closed-end or open-end. An example of conventiona.

View the full answer. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. Installment Loans and Open-End Credit Mindie Hunsaker is thinking about buying a car and getting a 3-year loan from her bank in the amount of 7200.

On the other hand a home equity line of credit HELOC is a secured type of open-end credit. Here are some types of loan installments. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University.

Credit cards and credit lines are examples of revolving credit. You take 10000 on an open-end loan. Examples of installment loans include mortgages auto loans student loans and personal loans.

For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22. Finally interest rates tend to be higher on open end credit similar to credit cards and personal lines of credit because there is. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans.

An auto loan is an example of this. Common examples of open-end credit are credit cards and lines of credit. Other examples include mortgages student loans and term loans.

A closed-end loan is frequently an installment loan in which the loan is issued for a specific amount and repaid in installment payments on a predetermined schedule. An open-end loan is a revolving line of credit issued by a lender or financial institution. By taking out a personal loan which is installment credit and using those funds to pay down your revolving credit outstanding balances.

Mortgage loans and automobile loans are examples of closed-end credit. Closed-End Credit Definition Investopedia. A fixed rate mortgage d.

Conversely home equity lines of credit HELOC and credit cards are examples of open-end credit. Auto loans are a loan that is secured usually with a fixed interest rate which you pay back in installments. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period.

With some forms of open-end credit theres no end date. Her monthly payment will be 200 7200 36 200. Examples of installment loans include auto loans mortgage loans personal loans and student loans.

Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. For example your credit limit could increase if your credit rating improves or decrease if the lender views you as a higher risk than when you applied. Lets give an example of an open-end loan.

T or F A True B False 2 Suppose you get a 775 installment loan and are charged a. A fixed-rate unsecured loan you pay back with fixed biweekly or monthly installments. Benefits And Drawbacks of Open End Credit Benefits.

Payments are usually of equal amounts. You use 8000 of it repay 5000 of it in the next couple of months 21. With this type of installment loan interest rates fall when the repayment term is short.

As you repay what youve borrowed you can draw from the credit line again and again.

What Are The Differences Between A Credit Card And A Debit Card

What Are Three Types Of Consumer Credit

Editable Legally Binding Promissory Note Template Doc Sample Promissory Note Notes Template Templates

Credit Report Business Plan Template Free Financial Plan Template Business Plan Template

Globe Vs Smart Iphone 5 Postpaid Plans Facts And Figures How To Plan Credit Card Charges Smart

Understanding Finance Charges For Closed End Credit

Lesson 16 2 Types Sources Of Credit Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

What Is Open End Credit Experian

Letter Proposing For Payment In Instalments Payment Plan Template Letter Lettering Letter Templates Business Plan Template Free

Personal Finance Chapter 6 Powerpoint

13 1 Compound Interest Simple Interest Interest Is Paid Only On The Principal Compound Interest Interest Is Paid On Both Principal And Interest Compounded Ppt Video Online Download

Fake Credit Report How To Create A Fake Credit Report Download This Fake Credit Report Template Now Doctors Note Template Report Template Experian Credit

Understanding Different Types Of Credit Nextadvisor With Time

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)